How to Improve Your Credit Score Using a Credit Card

Introduction

A good credit score is essential for securing favorable interest rates on loans, qualifying for credit cards with better rewards, and even renting an apartment. Using a credit card responsibly is one of the most effective ways to build and improve your credit score. Here’s a comprehensive guide on how to improve your credit score using a credit card

Understand Your Credit Score

What It Is: Your credit score is a three-digit number that represents your creditworthiness. It is calculated based on your credit history, which includes your payment history, amounts owed, length of credit history, new credit, and types of credit used.

Why It Matters: Lenders use your credit score to determine the risk of lending you money. A higher credit score means lower risk, which can lead to better loan terms and interest rates.

Choose the Right Credit Card

What to Look For:

- Low Interest Rates: Look for cards with low APRs to minimize interest costs if you carry a balance.

- No Annual Fees: Choose a card with no annual fee to avoid additional costs.

- Rewards and Benefits: Opt for cards that offer rewards or benefits that align with your spending habits.

Why It Matters: The right credit card can help you manage your finances better and provide additional perks. Choose a card that suits your needs and spending habits to maximize benefits.

Make On-Time Payments

What to Do:

- Set Up Reminders: Use calendar reminders or automatic payments to ensure you never miss a payment.

- Pay More Than the Minimum: Aim to pay off your balance in full each month to avoid interest charges.

Why It Matters: Payment history accounts for 35% of your credit score. Making on-time payments consistently shows lenders that you are responsible and can manage credit effectively.

Keep Credit Utilization Low

What It Is: Credit utilization is the ratio of your credit card balances to your credit limits. It is recommended to keep this ratio below 30%.

Why It Matters: Credit utilization accounts for 30% of your credit score. Lower utilization indicates that you are not overly reliant on credit, which is favorable to lenders.

Increase Your Credit Limit

How to Do It:

- Request a Credit Limit Increase: Contact your credit card issuer and request an increase in your credit limit.

- Open a New Credit Card: Applying for a new card can also increase your total available credit.

Why It Matters: Increasing your credit limit can lower your credit utilization ratio, which can positively impact your credit score. However, avoid using the increased limit to accumulate more debt.

Monitor Your Credit Report

What to Look For:

- Check for Errors: Review your credit report for any inaccuracies or fraudulent accounts.

- Track Your Progress: Regularly monitor your credit score to see how your actions are affecting it.

Why It Matters: Errors on your credit report can negatively impact your credit score. By monitoring your report, you can catch and dispute any mistakes, ensuring your score accurately reflects your creditworthiness.

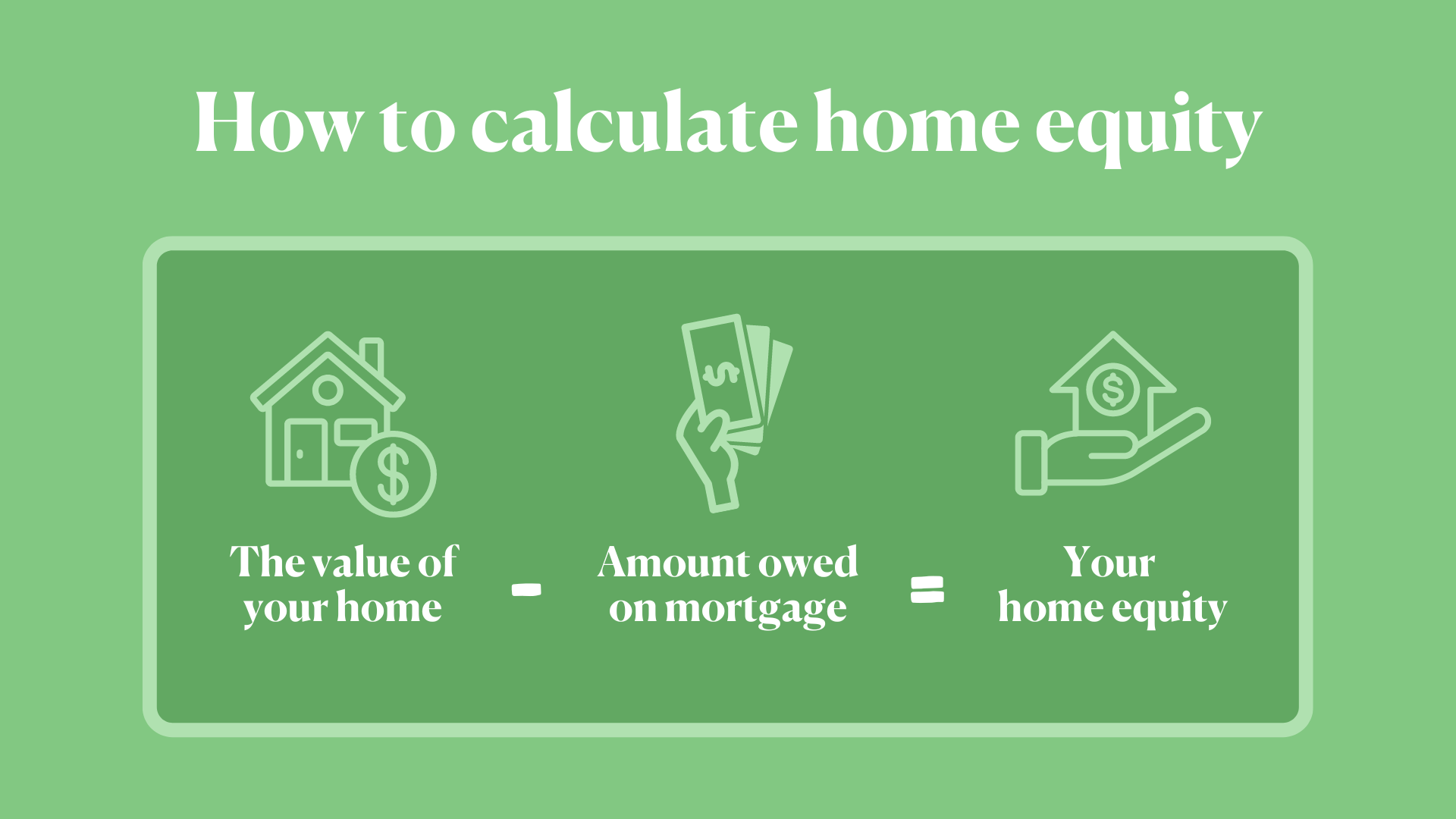

Diversify Your Credit Mix

What It Is: Your credit mix refers to the different types of credit accounts you have, such as credit cards, mortgages, and auto loans.

Why It Matters: Credit mix accounts for 10% of your credit score. Having a variety of credit types shows lenders that you can manage different kinds of credit responsibly.

Limit Hard Inquiries

What They Are: Hard inquiries occur when a lender checks your credit report as part of the application process. Each hard inquiry can lower your credit score by a few points.

Why It Matters: Too many hard inquiries in a short period can signal to lenders that you are a higher risk. Limit new credit applications to avoid unnecessary hard inquiries.

Use Credit Card Rewards Wisely

How to Do It:

- Redeem Rewards Regularly: Make use of your rewards points or cashback benefits.

- Avoid Overspending: Don’t let the allure of rewards tempt you into spending more than you can afford.

Why It Matters: Using credit card rewards responsibly can provide additional financial benefits without compromising your credit score.

Seek Professional Advice

When to Do It:

- Complex Financial Situations: If you have a complicated financial situation, consider seeking advice from a financial advisor.

- Credit Counseling: Look for credit counseling services that can provide personalized advice and strategies.

Why It Matters: Professional advice can provide you with tailored strategies to improve your credit score based on your unique financial situation.

Conclusion

Improving your credit score using a credit card requires discipline, strategy, and an understanding of how credit works. By making on-time payments, keeping credit utilization low, and monitoring your credit report, you can positively impact your credit score. Remember to choose the right credit card, use it wisely, and seek professional advice when needed. With these tips, you’ll be well on your way to a better credit score and greater financial freedom.